Evolving BGB: Governance, Gas, and Growth on Morph

Thank you for your continued support throughout the Morph and Bitget ecosystem integration. This tokenomics update builds on the September 2025 announcement and provides detailed clarity on BGB's role within the broader Morph ecosystem.

BGB’s evolution reflects the continued collaboration between Morph and its partners, including Bitget and Bitget Wallet. As the Morph ecosystem grows, our partners remain closely aligned in BGB's decentralized utility and shared purpose, supporting its transition to a truly onchain asset that powers a wider DeFi network.

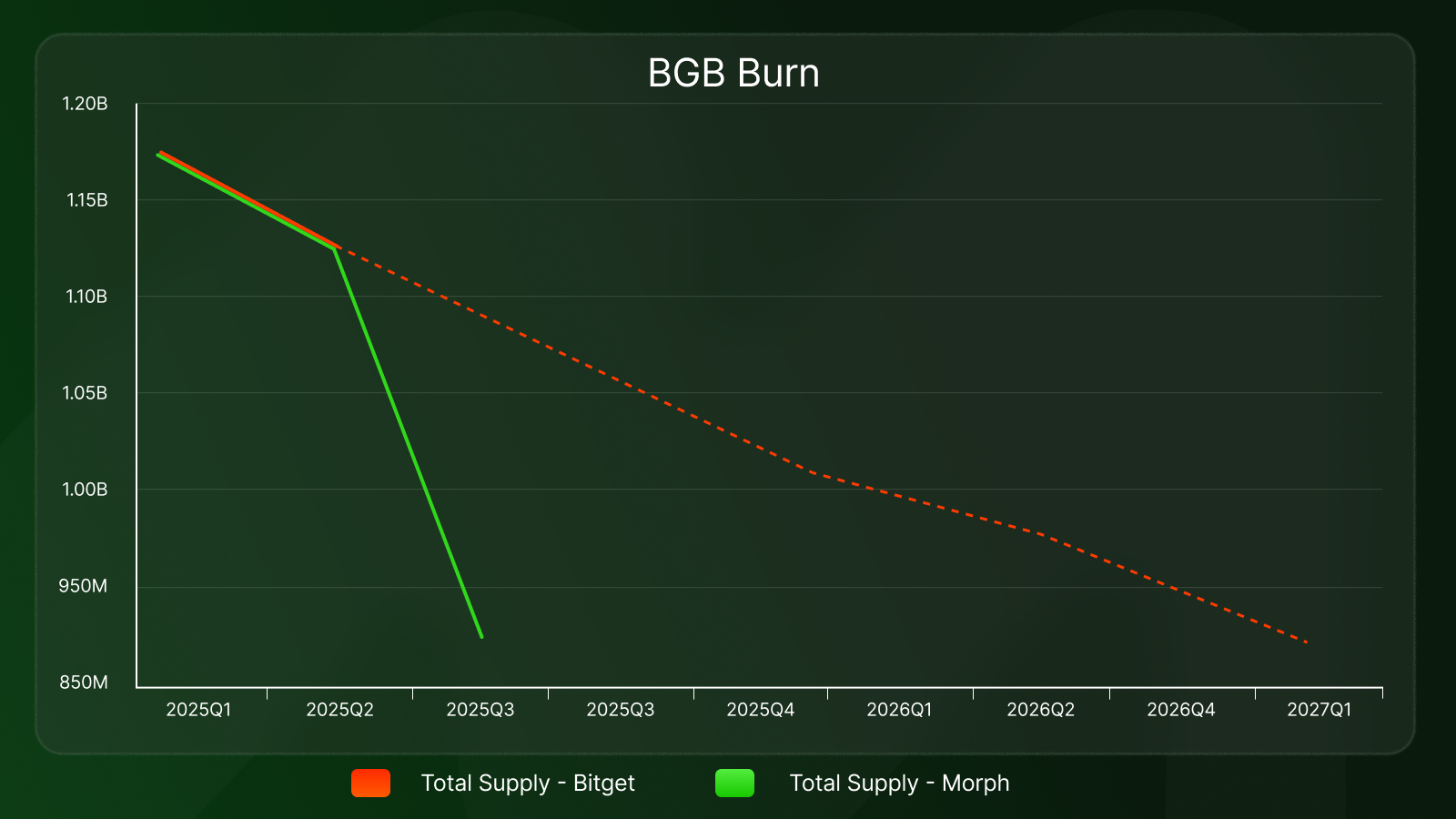

In September, Bitget transferred 440 million BGB to the Morph Foundation and immediately burned 220 million tokens[1]. The remaining allocation will support long-term Morph ecosystem development through listing, builder incentives, and adoption initiatives.

The recent BGB burn as part of the September announcement puts BGB materially ahead of its earlier trajectory, previously expected to burn on average 30 million BGB per quarter. With 220 million BGB already burned, the ecosystem is operating more than seven quarters ahead of schedule.

Morph's mission centers on building the decentralized settlement layer for global payments and BGB supports these objectives through its functions in gas, governance, and growing utility across the ecosystem. Whether you are new to BGB and Morph or a long-term holder, we hope you're as excited as we are to shape the next evolution of onchain value movement for everyone, everywhere.

BGB’s tokenomics going forward are not only directly linked to Morph's network growth but extend beyond the Morph ecosystem into DeFi, creating long-term alignment between usage and value. Monthly unlocks provide steady liquidity, while utility-based, transaction-driven burn mechanisms decided by the BGB community introduce transparency, decentralization and sustainability to the ecosystem. This structure aligns incentives for users and developers, establishing a self-sustaining economy that bridges crypto-native tools with real world applications.

BGB as the Multi-Ecosystem Token of the Network

BGB powers Morph’s core functions across gas, governance, and settlement. With the recent Viridian Upgrade and support for EIP-7702, users will soon be able to pay transaction fees directly in BGB, making it one of the first ERC-20 tokens to serve as native gas on a Layer 2 network. This upgrade transforms BGB into a foundational part of Morph’s payment infrastructure.

The Morph Foundation Treasury currently holds 220 million BGB, released at a fixed rate of 2% per month. Any undistributed tokens remain locked and do not automatically enter circulation.

As network usage expands, a portion of ecosystem fees will be allocated to token burns, directly linking BGB’s circulation to overall network activity - as decided by the community. This creates a sustainable feedback loop where higher onchain activity leads to increased burning, reinforcing BGB’s long-term value within the ecosystem.

Over time, the new roadmap can reinforce BGB’s role as a multi-ecosystem token across major partner ecosystems, including Morph, Bitget, and Bitget Wallet. Each partner contributes different forms of utility, liquidity, and adoption. As usage scales across these ecosystems, BGB’s path toward a 100 million supply becomes tied to sustained ecosystem activity rather than forced reductions.

Treasury Allocation (220M BGB)

The Morph Foundation Treasury is allocated to priority areas that directly support sustainable network growth. Any changes to these allocations will be disclosed promptly to maintain transparency for all BGB holders.

Quarterly Burn Mechanism

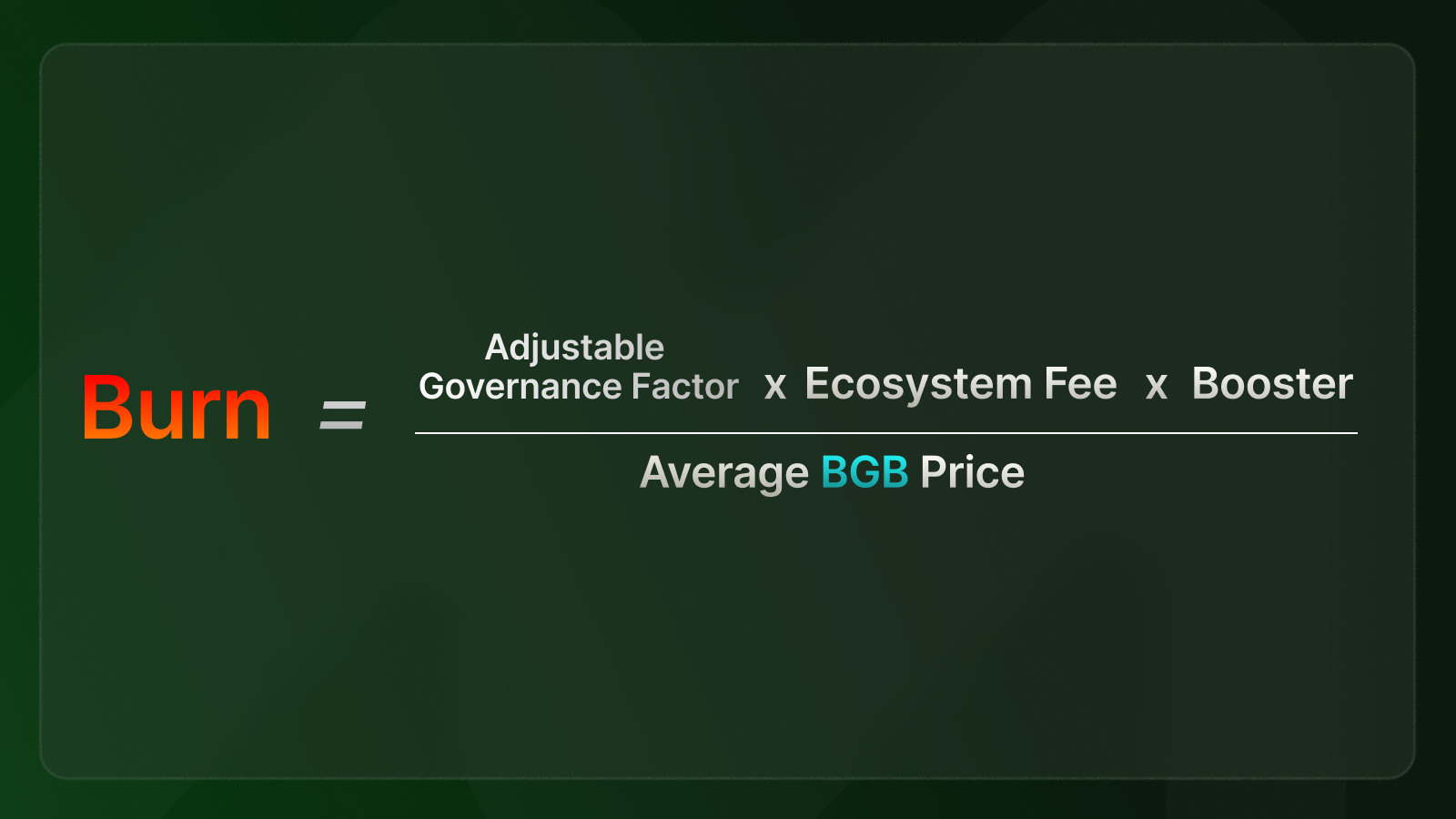

The updated quarterly burn mechanism links BGB’s supply directly to its usage within the Morph ecosystem. Each quarter, the amount of BGB to be burned is determined by objective, publicly disclosed factors such as Ecosystem Fee Value, the Average BGB Price, and community-defined parameters.

Key Metrics

- Ecosystem Fee Value: Total quarterly aggregated protocol fees, denominated in USD, which represent fees that users pay on transactions, minus Layer 1 fees paid to Ethereum.

- Average BGB Price: Time-weighted average price of BGB in USD, calculated daily based on BGB price data from Bitget.

- Adjustable Governance Factor: A baseline constant indexed at 100% that establishes the minimum burn ratio. This factor is intended to be set and adjusted through community voting to maintain long term balance as the network evolves.

- Booster: A governance controlled multiplier that increases the total burn amount. The Booster level is intended to be decided and adjusted through community voting so the community can calibrate burn intensity based on network maturity. In the near term, a higher Booster will offset lower protocol fees to ensure meaningful burns while the new version of the Morph payment network scales. As activity grows and protocol fees stabilize, the community can gradually reduce the Booster to maintain sustainable token consumption aligned with organic usage.

As BGB expands beyond its original context, it now participates in a much larger addressable market built around digital payments and onchain finance. The global payments sector is projected to generate $3 trillion in annual revenue by 2029[2]. BGB’s consumption naturally scales with this broader economic activity, and every new integration or payment flow strengthens its role within this expanding market.

BGB in DeFi

DeFi is a natural home for BGB and a core part of our strategy to position it as a thriving onchain asset. Within DeFi, BGB enhances utility for holders through collateralization in lending protocols, staking, and other mechanisms that temporarily lock tokens out of circulation. Holders can deploy their tokens productively while supporting long-term value growth

The Morph Foundation will actively support emerging DeFi projects through targeted BGB grants, prioritizing builders who deepen token utility and integrate BGB directly into their products. BGB’s deep liquidity, strong alignment with Morph’s infrastructure, and broad holder base create a compelling foundation for builders looking to scale high-quality DeFi applications. As more teams create BGB-integrated protocols, usage expands and transaction-based burns increase, reinforcing supply discipline and long-term ecosystem health.

Through this approach, BGB is positioned to become a foundational token across the Morph ecosystem and the broader PayFi landscape, connecting DeFi, payments, and real-world onchain value movement into a more cohesive onchain network.

Payments and Incentives

BGB supports Morph’s mission to make stablecoin and digital payments native to the onchain economy. It powers merchant rewards, payment incentives, and programs that drive adoption across global payment partners. Payment use cases unlock a much larger global market than traditional crypto activity. While crypto native usage today reaches tens of millions of users, global payment rails connect more than one billion people. By anchoring settlement, incentives, and network activity for these flows, BGB now serves an addressable market that is several orders of magnitude larger than its original context.

A portion of the BGB Treasury is allocated to accelerator programs that fund early-stage payment companies and developers building on Morph. These initiatives include pilot programs, integration rewards, and partnership incentives that advance real-world adoption of onchain payments.

While these programs may increase circulating BGB in the near term, they expand practical utility across payment networks. As more payment flows occur on Morph, BGB usage for fees and incentives will grow in parallel, linking real transaction volume directly to long-term token usage.

Through these programs, BGB is positioned to become the asset that anchors Morph’s settlement layer, connecting stablecoins, DeFi, and real-world payments into a unified onchain network.

Exchange Listings and Expansion

As BGB transitions to a native onchain utility token that supports the wider ecosystem’s long-term decentralization, it will pursue listings on major regulated exchanges to improve liquidity and global accessibility. Aligning onchain and offchain access will strengthen BGB’s position as both a network utility and a widely recognized token.

Decentralization also means BGB can now be adopted by a wider range of ecosystem participants. Exchanges, wallets, and payment platforms can integrate BGB directly to support network activity, creating a more open and distributed foundation for future growth.

The Road Ahead

As BGB’s utility expands across the Morph ecosystem, it creates a long-term value correlation between network activity and tokeneconomics. Over time, BGB will continue to decentralize through governance reserves, builder grants, and community-led initiatives that distribute control and rewards.

Every upgrade and integration will reinforce this cycle, positioning BGB as the backbone of the global PayFi and Defi ecosystem. We’re grateful to share this journey with you as we build an open, connected infrastructure powering the onchain economy for everyone, everywhere.

Learn more in the Frequently Asked Questions.

[1] Burn address: 0x000000000000000000000000000000000000dEaD

[2] Source: McKinsey & Company, Global Payments Report 2024. McKinsey projects global payments revenue to reach approximately $3 trillion by 2029.